In this case study, we’ll give you a step-by-step breakdown of how Logic Inbound was able to propel Redwood Valuation Partners LLC (aka Redwood Valuation) to the front page of Google on short notice to capitalize on a competitor’s acquisition.

What is Redwood Valuation?

Redwood Valuation is second largest 409A valuations in the country, with over 700 clients. They’ve done valuations for firms large and small, including WhatsApp, Robinhood, FitBit, Pitchbook and Logic Inbound.

The Challenge

Silicon Valley Bank, or SVB, was the single largest 409A valuation provider in the country at about 1300 clients.

Word got out that SVB Analytics (the division responsible for 409A valuations) was going to be acquired by eShares, an automated valuation shop with fewer clients and a weaker reputation. The first way Redwood heard of this? A client received a weird email from SVB saying they should sign their information over to eShares.

Redwood Valuation knew that this acquisition would have serious repercussions for existing SVB 409A clients. There’s a meaningful difference between the way SVB and eShares operate:

- eShares charges 409A customers using a subscription model, despite the fact that 409A customers may not need additional work done on their behalf for several years at a time. This model doesn’t make sense for most customers. SVB and Redwood both used a fee-based model.

- Former SVB customers have serious doubts about whether eShares will support 409A valuations made by SVB. This concern was exacerbated when eShares required those former SVB customers to register with eShares in a very short window of time. The implication was that those who fail to sign up in this window would not be supported.

- 409A providers that are venture-backed, like eShares, have an increased risk of going out of business. A 409A from a provider that is no longer in business cannot be supported.

- eShares also claims to have a “fully automated” 409A solution, yet it takes 7 to 10 days to fulfill. That means it can’t really be automated. Instead, Redwood Valuations saw this as an excuse for poor customer service.

The idea was simple: how do we get this information about legitimate concerns in front of current SVB customers? How can we amplify the legitimacy of these concerns while driving traffic toward the strongest competing alternative, Redwood Valuation? If enough current SVB 409A customers or interested investors read about the numerous client concerns regarding this acquisition, Redwood Valuation can claim some of the client attrition for themselves.

Logic Inbound’s Strategy

Logic Inbound developed a strategy combining concepts from guerilla PR and SEO to get this important information in front of wary SVB 409A customers. The key to this strategy was to act quickly: we had only a matter of days before a formal announcement of the acquisition was expected to happen.

The first step was developing a blog post about the possible SVB acquisition and its problems to host on Redwood Valuation’s own site. We worked with Redwood on this to ensure that the claims we were making were accurate and spoke to the primary concerns of 409A valuation clients. Then we applied our SEO tactics and optimization to the blog to ensure Google would quickly recognize the page as authoritative on the subject of the eShares acquisition.

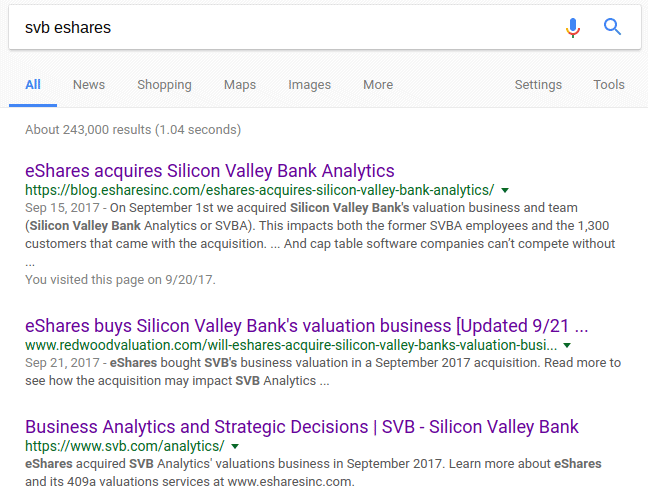

Next, Logic Inbound distributed a press release pointing to and citing the Redwood Valuation blog post. Because there was little discussion on the relationship between eShares and SVB on the web prior to our blog and press release, our SEO tactics pushed it to immediately claim the top spot on Google.

What’s more, when SVB posted their own announcement, it ranked below the Redwood Valuation links on Google, and it still does as of the writing of this case study.

The Outcome

- Our press release was picked up by hundreds of distributors, driving 1,112 views on the press release linking to Redwood Valuation’s blog post.

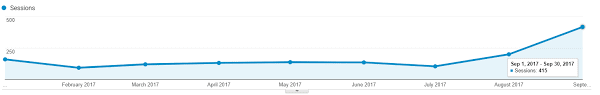

- Organic search traffic increased 295%, rocketing from 105 visitors in July to 415 visitors in September.

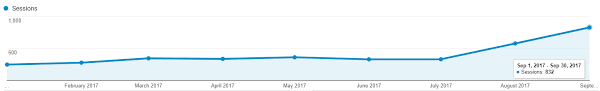

Overall website traffic increased 150%, from 333 visits to 832 in that same two month time period.